Pharmacist professional liability insurance is coverage designed to protect pharmacists when a patient claims an actual or alleged error or omission within the scope of your practice.

No pharmacist acts with the intent to harm patients. However, the busy and fast-paced environment of pharmacy working conditions, coupled with the massive volume of prescriptions, opens the door to mistakes and errors. Additionally, the evolving nature of pharmacy practice puts pharmacists in new roles that carry new considerations. For these reasons, no pharmacist should risk practicing without adequate pharmacist liability insurance.

Claims-Made vs. Occurrence

Claims-Made

Occurrence

Pharmacists Mutual offers both Claims-Made and Occurrence policies, although we may write certain coverages on a specific type of policy. For example, our professional liability policies mainly have Claims-Made coverage, while general liability insurance is typically available as an Occurrence policy.

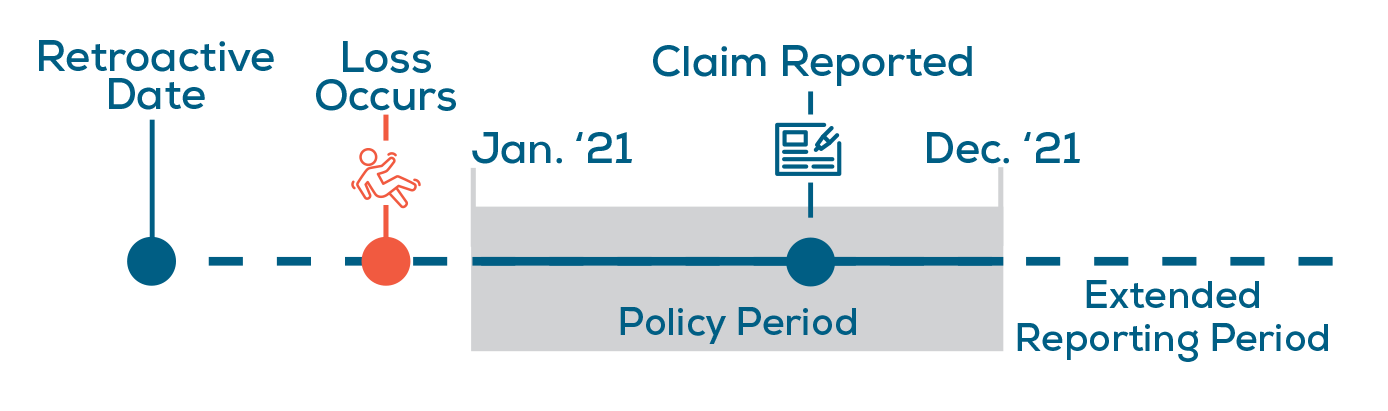

What is a Claims-Made Policy?

- It provides coverage for a loss occurring after the retroactive date and before the end of the policy period, as long as the claim is reported during the policy period or extended reporting period.

- The applicable coverage provided is from the policy in force at the time the claim is made and reported.

- An extended reporting period may be purchased when a Claims-Made policy is canceled to extend the timeframe in which a covered claim may be reported.

CLAIMS-MADE EXAMPLE

This claim may be eligible for coverage under a Claims-Made policy because the incident or loss was reported during the policy period, and the loss occurred after the retroactive date. The loss may also be covered if it was reported after the policy’s expiration but within the extended reporting period.

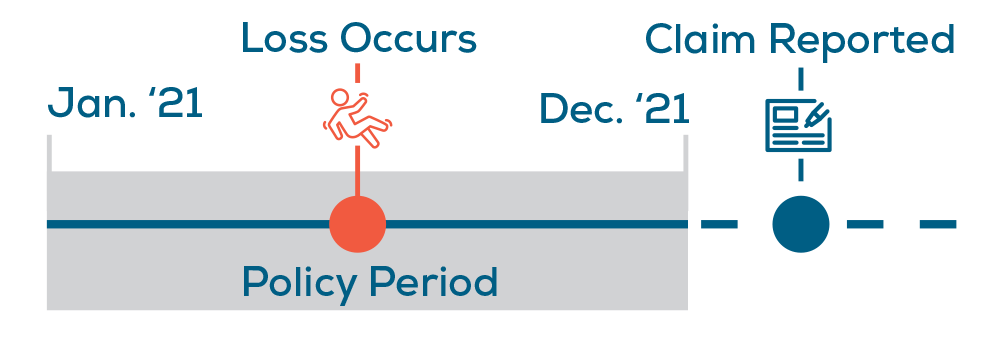

WHAT IS AN OCCURRENCE POLICY?

- It provides coverage for a loss occurring during the policy period, regardless of when the claim is reported, as long the incident occurred within the policy period.

- The applicable coverage provided is from the policy in force at the time of the incident.

OCCURRENCE EXAMPLE:

This claim may be eligible for coverage under an Occurrence policy because the incident or loss occurs within the policy period even though it is reported after its expiration date.

Are you ready to safeguard the investment you’ve made in your career? Click the link below to apply for our Individual Pharmacist Professional Liability Policy. For more information, contact our team below or find a local field agent in your area.